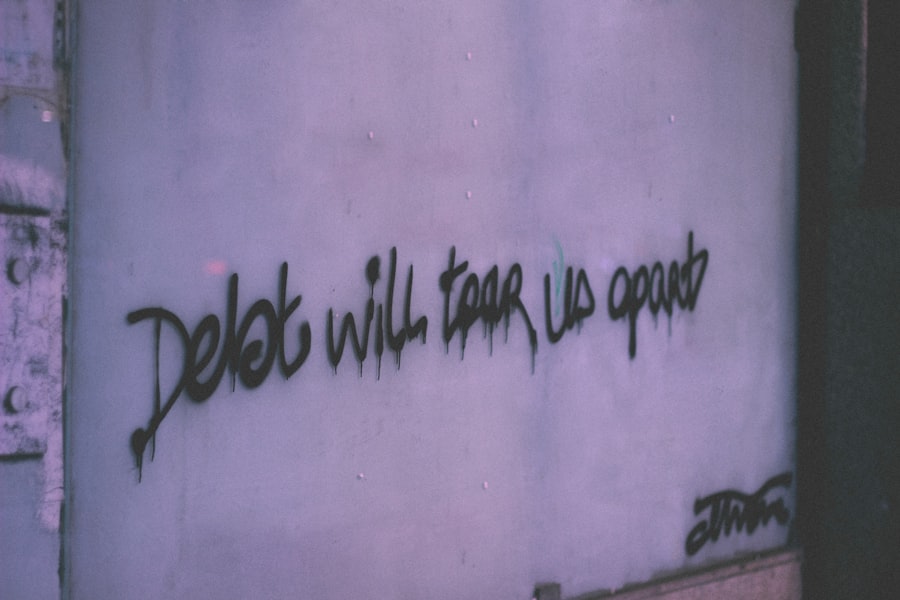

Managing debt is an essential aspect of personal finance. It can be overwhelming and stressful to have multiple debts with different interest rates and payment terms. Debt consolidation is a strategy that can help individuals simplify their debt repayment process and potentially save money in the long run. In this blog post, we will explore the concept of debt consolidation, discuss various debt consolidation options, provide tips for assessing your current financial situation, creating a budget, choosing the right solution, applying for a debt consolidation loan, negotiating with creditors, paying off credit card debt, managing student loan debt, maintaining a debt-free lifestyle, and seeking professional help when necessary.

Understanding Debt Consolidation: What It Is and How It Works

Debt consolidation is the process of combining multiple debts into one single loan or payment. This can be done through various methods such as taking out a personal loan, using a balance transfer credit card, or utilizing a home equity loan or line of credit. The goal of debt consolidation is to simplify the repayment process by having only one monthly payment to make instead of multiple payments to different creditors.

There are different types of debt consolidation options available depending on an individual’s financial situation and preferences. Personal loans are a common choice for debt consolidation as they allow borrowers to pay off their existing debts and then make one fixed monthly payment towards the loan. Balance transfer credit cards offer an introductory period with low or 0% interest rates on transferred balances, allowing individuals to consolidate their credit card debts onto one card. Home equity loans or lines of credit use the equity in a home as collateral to secure a loan for consolidating debts.

Assessing Your Current Financial Situation: Identifying Your Debts and Expenses

Before embarking on a debt consolidation journey, it is crucial to assess your current financial situation. This involves identifying all of your debts and expenses. Start by making a list of all your debts, including credit cards, personal loans, student loans, and any other outstanding balances. Note down the interest rates, minimum monthly payments, and total outstanding balances for each debt.

Next, track your monthly expenses to get a clear picture of where your money is going. This includes fixed expenses such as rent or mortgage payments, utilities, and insurance, as well as variable expenses like groceries, dining out, entertainment, and transportation. By understanding your debts and expenses, you can determine how much you can afford to allocate towards debt repayment each month.

Creating a Budget: Managing Your Income and Expenses

| Category | Metric |

|---|---|

| Income | Total monthly income |

| Expenses | Total monthly expenses |

| Expenses | Fixed expenses (rent, utilities, etc.) |

| Expenses | Variable expenses (groceries, entertainment, etc.) |

| Savings | Amount saved each month |

| Debt | Total amount of debt |

| Debt | Minimum monthly debt payments |

| Goals | Amount needed to save for specific goals (vacation, emergency fund, etc.) |

Creating a budget is an essential step in managing your income and expenses effectively. Start by calculating your total monthly income from all sources. This includes your salary, any additional sources of income, and government benefits. Once you have determined your income, allocate a portion towards essential expenses such as housing, utilities, transportation, and groceries.

Next, allocate a portion towards debt repayment. This is where debt consolidation comes into play. By consolidating your debts into one single payment, you can determine how much you can afford to allocate towards debt repayment each month. It is important to prioritize paying off high-interest debts first to save money on interest charges.

Finally, allocate a portion towards discretionary expenses such as dining out, entertainment, and vacations. It is important to strike a balance between enjoying your life and being responsible with your finances. By creating a budget and sticking to it, you can effectively manage your income and expenses while working towards becoming debt-free.

Exploring Debt Consolidation Options: Choosing the Right Solution for You

When it comes to debt consolidation options, there are several factors to consider in order to choose the right solution for your specific financial situation. Personal loans are a popular choice for debt consolidation as they offer fixed interest rates and predictable monthly payments. They are also unsecured loans, meaning they do not require collateral.

Balance transfer credit cards can be a good option if you have high-interest credit card debt. These cards offer an introductory period with low or 0% interest rates on transferred balances, allowing you to save money on interest charges. However, it is important to read the terms and conditions carefully, as there may be balance transfer fees and the introductory period may be limited.

Home equity loans or lines of credit are secured loans that use the equity in your home as collateral. These loans typically offer lower interest rates compared to personal loans or credit cards. However, it is important to consider the risks involved, as your home is at stake if you are unable to make the loan payments.

Applying for a Debt Consolidation Loan: Tips for a Successful Application

When applying for a debt consolidation loan, there are several tips to keep in mind to increase your chances of a successful application. First, check your credit score and credit report to ensure they are accurate and up-to-date. Lenders will review your credit history when considering your loan application.

Next, gather all the necessary documents such as proof of income, bank statements, and identification. Having these documents ready will streamline the application process and increase your chances of approval. It is also important to compare different lenders and their loan terms to find the best option for your needs.

When filling out the application, be honest and accurate with your financial information. Lenders will verify the information provided, so it is important to provide accurate details. Finally, be prepared for a potential credit check and understand that applying for a loan may temporarily impact your credit score.

Negotiating with Creditors: Lowering Interest Rates and Payment Terms

Negotiating with creditors can be a beneficial strategy when consolidating debt. By reaching out to your creditors and explaining your financial situation, you may be able to negotiate lower interest rates or more favorable payment terms. This can help reduce the overall cost of your debts and make them more manageable.

When negotiating with creditors, it is important to be prepared and have a clear understanding of your financial situation. Be honest about your ability to make payments and propose a realistic repayment plan. It is also helpful to have a clear goal in mind, such as reducing the interest rate or extending the repayment term.

Remember to stay calm and polite during the negotiation process. Creditors are more likely to work with you if you approach them respectfully and demonstrate a genuine willingness to repay your debts. Keep in mind that not all creditors may be willing to negotiate, but it is worth trying as it can potentially save you money and make your debts more manageable.

Consolidating Credit Card Debt: Strategies for Paying Off High-Interest Debt

Credit card debt can be particularly challenging due to high-interest rates. When consolidating credit card debt, there are several strategies that can help you pay off your debts more efficiently. One strategy is to transfer your credit card balances onto a balance transfer credit card with a low or 0% introductory interest rate. This can help you save money on interest charges and pay off your debts faster.

Another strategy is to prioritize paying off high-interest credit card debt first. By allocating more money towards the highest interest rate debt while making minimum payments on other debts, you can save money on interest charges in the long run. This is known as the debt avalanche method.

Consider making extra payments towards your credit card debts whenever possible. Even small additional payments can make a significant difference in reducing your overall debt and saving money on interest charges. It is also important to avoid accumulating new credit card debt while paying off existing balances.

Managing Student Loan Debt: Consolidation and Repayment Options

Student loan debt can be a significant burden for many individuals. When managing student loan debt, there are several consolidation and repayment options available. Federal student loans can be consolidated through a Direct Consolidation Loan, which combines multiple federal loans into one loan with a fixed interest rate.

Private student loans can also be consolidated through refinancing. This involves taking out a new loan with a private lender to pay off your existing student loans. Refinancing can potentially lower your interest rate and monthly payment, but it is important to consider the terms and conditions of the new loan.

When it comes to repayment options, federal student loans offer various plans such as income-driven repayment plans, which base your monthly payment on your income and family size. Public Service Loan Forgiveness is another option for individuals working in qualifying public service jobs who make 120 qualifying payments towards their federal student loans.

Staying on Track: Tips for Maintaining a Debt-Free Lifestyle

After consolidating your debts, it is important to stay on track and maintain a debt-free lifestyle. One tip is to continue budgeting and tracking your expenses. By keeping a close eye on your finances, you can ensure that you are living within your means and not accumulating new debts.

Consider setting financial goals for yourself, such as saving for emergencies or retirement. By having clear goals in mind, you can stay motivated and focused on maintaining a debt-free lifestyle. It is also important to build an emergency fund to cover unexpected expenses and avoid relying on credit cards or loans.

Avoid unnecessary spending and impulse purchases. Before making a purchase, ask yourself if it is something you truly need or if it is just a want. By being mindful of your spending habits, you can avoid falling back into debt.

Seeking Professional Help: When to Consider Credit Counseling or Debt Settlement Services

In some cases, it may be necessary to seek professional help when managing debt. Credit counseling is a service that provides guidance and support in managing debt and improving financial literacy. Credit counselors can help individuals create a budget, negotiate with creditors, and develop a debt repayment plan.

Debt settlement services are another option for individuals struggling with debt. These services negotiate with creditors on your behalf to reduce the total amount owed. However, it is important to be cautious when considering debt settlement services, as they may have fees and can potentially have a negative impact on your credit score.

If you are considering professional help, do thorough research and choose reputable organizations or agencies. Look for non-profit organizations that offer free or low-cost services and have certified counselors. It is also important to understand the fees involved and any potential risks before committing to any services.

Managing debt is a crucial aspect of personal finance. Debt consolidation can be an effective strategy for simplifying the repayment process and potentially saving money on interest charges. By assessing your current financial situation, creating a budget, choosing the right debt consolidation option, negotiating with creditors, paying off high-interest debt, managing student loan debt, maintaining a debt-free lifestyle, and seeking professional help when necessary, you can take control of your finances and work towards becoming debt-free. Take action today and start managing your debt to achieve financial freedom.

Add Comment