The allure of quick wealth and financial freedom is something that many people dream of. The idea of being able to make a large sum of money in a short amount of time is incredibly enticing. However, the reality is that the risks and dangers involved in chasing get-rich-quick schemes far outweigh the potential rewards.

The Dangers of Chasing Get-Rich-Quick Schemes: Financial Ruin and Scams

There are countless stories of people who have lost everything chasing get-rich-quick schemes. These schemes promise quick and easy money, but often end up leaving individuals in financial ruin. One example is the infamous Bernie Madoff Ponzi scheme, which defrauded investors out of billions of dollars. Many people who invested their life savings with Madoff ended up losing everything.

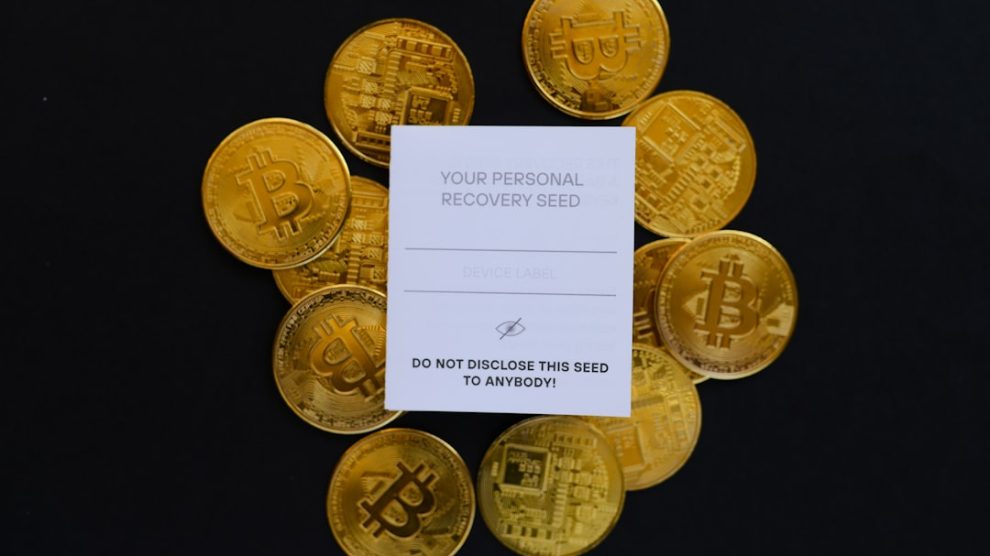

In addition to the risk of financial ruin, there is also a prevalence of scams and fraud in the world of get-rich-quick schemes. These scams often prey on individuals who are desperate for financial success and are willing to take risks. Scammers use various tactics to convince people to invest their money, promising high returns and guaranteed profits. However, these promises are often too good to be true, and individuals end up losing their hard-earned money.

Recognizing the Signs of a Get-Rich-Quick Scam: Red Flags to Watch Out For

There are several red flags that can help individuals recognize a get-rich-quick scam. One major red flag is the promise of guaranteed returns or profits. Legitimate investments always come with some level of risk, and there are no guarantees when it comes to making money in the financial markets.

Another red flag to watch out for is high-pressure sales tactics and urgency. Scammers often use tactics such as limited-time offers or exclusive opportunities to create a sense of urgency and pressure individuals into making quick decisions. Legitimate investment opportunities should never require individuals to make rushed decisions without proper time for research and consideration.

Lack of transparency or information about the company or investment opportunity is another red flag to be aware of. Legitimate companies and investments should have clear and easily accessible information available for potential investors. If a company or investment opportunity is unwilling to provide information or is evasive when asked questions, it is likely a scam.

Common Types of Get-Rich-Quick Schemes: Pyramid Schemes, Ponzi Schemes, and More

There are several different types of get-rich-quick schemes, each with its own warning signs and red flags. One common type of scheme is a pyramid scheme, where individuals are recruited to invest money and recruit others to do the same. The primary source of income in a pyramid scheme comes from recruiting new members, rather than from the sale of a legitimate product or service.

Another well-known type of scheme is a Ponzi scheme, named after Charles Ponzi who famously orchestrated one in the 1920s. In a Ponzi scheme, investors are promised high returns on their investments, which are paid out using funds from new investors. Eventually, the scheme collapses when there are not enough new investors to sustain the payouts.

Other types of get-rich-quick schemes include binary options trading scams, real estate investment scams, and multi-level marketing schemes. Each type of scheme has its own set of warning signs and red flags that individuals should be aware of in order to protect themselves from falling victim.

The Psychology of Get-Rich-Quick Schemes: Why People Fall for Them

There are several psychological factors that contribute to why people fall for get-rich-quick schemes. One major factor is greed. The promise of quick and easy money taps into individuals’ desire for wealth and financial success. This desire can cloud judgment and lead individuals to make irrational decisions.

Fear is another factor that plays a role in individuals’ decision-making when it comes to get-rich-quick schemes. The fear of missing out on an opportunity or the fear of not being able to achieve financial success can drive individuals to take risks that they would not normally take.

Social proof and peer pressure also play a role in why people fall for get-rich-quick schemes. Seeing others who have seemingly achieved financial success through these schemes can create a sense of social proof, making individuals believe that they too can achieve the same results. Peer pressure from friends or family members who are involved in the scheme can also influence individuals’ decisions to participate.

It is important for individuals to understand their own biases and emotions when it comes to making financial decisions. Being aware of these psychological factors can help individuals make more rational and informed choices when it comes to investing their money.

The Importance of Money Management: Building Wealth Slowly and Steadily

Instead of chasing get-rich-quick schemes, it is important to take a long-term, sustainable approach to wealth-building. Building wealth takes time and patience, and there are no shortcuts or quick fixes. By focusing on long-term goals and implementing sound money management strategies, individuals can build a strong financial future.

One of the key benefits of a long-term approach to wealth-building is the power of compound interest. By consistently saving and investing over time, individuals can take advantage of compounding returns, which can significantly increase their wealth over the long run. This is in contrast to get-rich-quick schemes, which often promise quick returns but fail to deliver sustainable growth.

Financial Management Strategies: Setting Goals, Budgeting, and Saving

Setting realistic financial goals is an important first step in building a strong financial future. These goals should be specific, measurable, achievable, relevant, and time-bound (SMART). By setting clear goals, individuals can create a roadmap for their financial journey and stay motivated along the way.

Budgeting is another crucial aspect of financial management. Creating a budget allows individuals to track their income and expenses, and ensure that they are living within their means. By identifying areas where they can cut back on spending and save more, individuals can free up money to invest and build wealth over time.

Saving for emergencies and long-term goals is also essential for financial success. Having an emergency fund can provide a safety net in case of unexpected expenses or job loss. Saving for long-term goals such as retirement or education can help individuals achieve their dreams and secure their financial future.

Investing Wisely: Diversification, Risk Management, and Long-Term Planning

When it comes to investing, it is important to diversify your portfolio. Diversification involves spreading your investments across different asset classes, industries, and geographic regions. This helps to reduce risk and protect against losses in any one investment.

Risk management is another important aspect of investing wisely. It is important to understand the level of risk associated with each investment and to only invest money that you can afford to lose. By diversifying your portfolio and understanding the risks involved, you can minimize the potential for losses.

Long-term planning is also crucial when it comes to investing. Trying to time the market or chase short-term gains often leads to poor investment decisions. Instead, focus on a long-term investment strategy that aligns with your goals and risk tolerance. By staying invested over the long run, you can take advantage of the power of compounding returns and achieve sustainable growth.

Protecting Yourself from Scams: Due Diligence, Research, and Common Sense

Protecting yourself from scams requires due diligence, research, and common sense. Before investing your money, take the time to thoroughly research the investment opportunity and the company offering it. Look for information about the company’s track record, financials, and any regulatory or legal issues.

Ask questions and seek out information from multiple sources. Legitimate companies and investment opportunities should be transparent and willing to provide information. If something seems too good to be true or if you feel pressured to make a decision, trust your instincts and walk away.

Common sense is also an important tool in avoiding scams and fraud. If an investment opportunity promises guaranteed returns or profits, it is likely a scam. If it sounds too good to be true, it probably is. By using common sense and being skeptical of overly optimistic claims, you can protect yourself from falling victim to scams.

Avoiding Get-Rich-Quick Schemes and Building a Strong Financial Future

In conclusion, it is important to avoid get-rich-quick schemes and instead focus on building a strong financial future through long-term, sustainable strategies. The risks and dangers involved in chasing quick wealth far outweigh the potential rewards. By understanding the signs of a scam, recognizing the psychological factors that contribute to falling for these schemes, and implementing sound money management and investment strategies, individuals can protect themselves and build a strong financial future.

Add Comment